International Ao Code For Pan Card Apply

AO code is the Assessing Officer’s code under whose jurisdiction the applicant’s ITR will fall. The person who is not resident in India as per the Income Tax Act should select one of the AO code from the below mentioned list. If you are unaware about the AO Code applicable to you, you may select default AO Code(DLC-C-35-1) below as your AO Code.

What AO code should NRIs use International PAN AO Code is DLC-C-35-1.

International Ao Code for pan card apply

| Area Code | AO Type | Range Code | AO No |

|---|---|---|---|

| DLC | C | 35 | 1 |

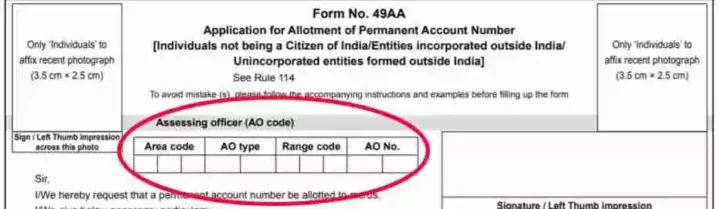

What is AO code in Pan card application?

When someone applicant for a new PAN card, there is one part of the application that asks them to enter an AO code. It is asked for right at the top of the Pan application form, AO Code is meant to identify the tax jurisdiction that the applicant will fall under. The abbreviation AO stands for Assessing Officer.

What is AO code in PAN Card for foreign citizens?

pan card ao code

What is AO code in PAN Card for foreign citizens?

For PAN Card foreign citizens Ao Code Is DLC-C-35-1, Area Code is “DLC” AO Type “C” Range Code “35” AO No “1” AO code is the Assessing Officer’s code under whose jurisdiction the applicant’s ITR will fall. This code has to be mentioned in the form when applying for a PAN card. Such applicants have to provide the AO code in the application which can be obtained from the Income Tax Office, International NRI CitizenAo Code for PAN Card Apply

Can I apply PAN Card without AO code? Applicants for PAN are required to provide the AO code in their application. This information can be obtained from the Income Tax Office. Applicants may search their AO Codes on the basis of description wherever provided. International AO Code For Pan Card Apply, Nri Citizen Pan Ao Code,usa, China , Japan, Germany, United Kingdom, France, Italy, Brazil, Canada, Kuwaiti Pan Ao code for indian pan card apply.

Does AO Code matters in PAN Card?

Find my Ao code for my pan card

| Indian Top City AO Code List | Link |

|---|---|

| ALIGARH PAN Card AO Code | ALIGARH PAN Area Code |

| Agra Pan Ao Code | AGRA Pan Area Code |

| ALLAHABAD Ao code for Pan Card | ALLAHABAD PAN Area Code |

| Guidelines |

| The person who is not resident in India as per the Income Tax Act should select one of the AO code from the below mentioned list. |

| If you are unaware about the AO Code applicable to you, you may select default AO Code(DLC-C-35-1) below as your AO Code. |

| The list of AO codes given below is to help the PAN applicant to choose the AO codes under whose jurisdiction the applicant of new PAN falls. The AO code for a given PAN may change across time as per the policy of Income Tax Department (PAN in such cases remains the same). To know the AO under whom the PAN holder is assessed at any point of time, the applicant will have to contact the local Income Tax Office. |

| [sp_easyaccordion id=”286″] |

| 160 number of AO Code records for International Taxation. |

| Select | Ward/Circle/Range/ Commissioner | Description | Area Code | AO Type | Range Code | AO Number |

| CIRCLE INTERNATIONAL TAXATION 1, DELHI | — | DLC | C | 35 | 1 | |

| CIRCLE INTERNATIONAL TAXATION 1 or 2 | — | DLC | C | 35 | 2 | |

| DC/AC(INTERNATIONAL TAXATION), BHOPAL | — | BPL | C | 38 | 1 | |

| DC/AC (INTERNATIONAL TAXATION) – I PUNE AT NASHIK | — | DLC | C | 85 | 1 | |

| DC/AC(INTERNATIONAL TAXATION)-II PUNE AT NASHIK | — | DLC | C | 85 | 2 | |

| CIRCLE INTERNATIONAL TAXATION 3(1)(1) DELHI | — | DLC | C | 121 | 21 | |

| CIRCLE INTERNATIONAL TAXATION 3(1)(2)DEL | — | DLC | C | 121 | 22 | |

| CIRCLE INTERNATIONAL TAXATION 2(1) (1) | — | DLC | C | 122 | 31 | |

| CIRCLE INTERNATIONAL TAXATION 2(1)(2) | — | DLC | C | 122 | 32 | |

| CIRCLE (INTERNATIONAL TAXATION), JAIPUR | — | DLC | C | 123 | 1 | |

| CIRCLE-1,INTERNATIONAL TAXATION, CHANDIGARH | — | DLC | C | 124 | 1 | |

| DCIT/ACIT(INTERNATIONAL TAXATION)-I, AT NAGPUR | — | DLC | C | 130 | 1 | |

| DCIT/ACIT(INTERNATIONAL TAXATION)-II, at NAGPUR | — | DLC | C | 130 | 2 | |

| DC/AC INTERNATIONAL_TAXATION-I, PUNE AT KOLHAPURE | — | DLC | C | 132 | 1 | |

| DC/AC INTERNATIONAL TAXATION-II, PUNE AT KOLHAPURE | — | DLC | C | 132 | 2 | |

| DC/ACIT (INTERNATIONAL TAXATION), JABALPUR | — | BPL | C | 138 | 1 | |

| DCIT/ACIT-INTERNATIONAL TAXATION GURGAON | — | DLC | C | 200 | 1 | |

| CIRCLE INTERNATIONAL TAXATION 1(2)(1) | — | DLC | C | 254 | 1 | |

| CIRCLE INTERNATIONAL TAXATION 1(2)(2) | — | DLC | C | 254 | 2 | |

| CIRCLE INTERNATIONAL TAXATION 1(3)(1) | — | DLC | C | 255 | 1 | |

| CIRCLE INTERNATIONAL TAXATION 2(2)(1) | — | DLC | C | 256 | 1 | |

| CIRCLE INTERNATIONAL TAXATION 2(2)(2) | — | DLC | C | 256 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 1(2)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘BA’ TO ‘BB’ | DLC | C | 280 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 1(2)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘BC’ TO ‘BL’ | DLC | C | 280 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 1(3)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘BM’ TO ‘BQ’ | DLC | C | 281 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 1(3)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘BR’ TO ‘BZ’ | DLC | C | 281 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 2(1)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘C’ | DLC | C | 283 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 2(1)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘D’ | DLC | C | 283 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 2(3)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘F’ | DLC | C | 284 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 2(3)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘G’ | DLC | C | 284 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 3(1)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘J’ | DLC | C | 286 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 3(1)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘K’,’L’ | DLC | C | 286 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 3(3)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘N’,’Q’ | DLC | C | 287 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 3(3)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘P’ | DLC | C | 287 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 4(2)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘SA’ TO ‘SM’ | DLC | C | 289 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 4(2)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘SN’ TO ‘SZ’ | DLC | C | 289 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 4(3)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘U’,’V’ | DLC | C | 290 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 4(3)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘W’ TO ‘Z’ | DLC | C | 290 | 2 | |

| (IT) CIRCLE 1, PUNE | — | DLC | C | 400 | 1 | |

| (IT) CIRCLE 2, PUNE | — | DLC | C | 400 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 1(1), BANGALORE | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF BANGALORE URBAN AND RURAL AND HAVING/CONTAINING THE FIFTH LETTER/CHARACTER IN THE PAN FROM A TO J OR LAST NAME/SURNAME STARTING WITH LETTER/CHARACTER A TO J IN CASES WHERE PAN HAS NOT BEEN OBTAINED, HAVING LATEST RETURNED INCOME/LOSS MORE THAN RS.20 LAKHS (RS.30 LAKHS IN CASE OF FOREIGN COMPANIES) AND AREA LYING WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF CHIKBALLAPUR, CHAMARAJANAGAR, HASSAN, KOLAR, MANDYA, RAMNAGARA, MYSORE AND TUMKUR IN THE STATE OF KARNATAKA. | DLC | C | 510 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 1(2), BANGALORE | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF BANGALORE URBAN AND RURAL IN THE STATE OF KARNATAKA AND HAVING/CONTAINING THE FIFTH LETTER/CHARACTER IN THE PAN FROM K TO R OR LAST NAME/SURNAME STARTING WITH LETTER/CHARACTER K TO R IN CASES WHERE PAN HAS NOT BEEN OBTAINED, HAVING LATEST RETURNED INCOME/LOSS MORE THAN RS.20 LAKHS (RS.30 LAKHS IN CASE OF FOREIGN COMPANIES). | DLC | C | 510 | 2 | |

| CIRCLE 1(1), IT, KOLKATA | TERRITORIAL AREA:WEST BENGAL(EXCEPT THE DIST OF EAST MIDNAPORE):CASES> ALL NON-RESIDENTS INCLUDING FOREIGN COMPANIES WITH NAMES STARTING FROM A TO L; TERRITORIAL AREA:>ANDAMAN & NICOBOR ISLANDS & SIKKIM & CLASSIFICATION OF CASES:>ALL NON-RESIDENTS INCLUDING FOREIGN COMPANIES | DLC | C | 511 | 1 | |

| CIRCLE 1(2),IT, KOLKATA | — | DLC | C | 511 | 2 | |

| CIRCLE 2(1), IT, KOLKATA | TERRITORIAL AREA:WEST BENGAL (EXCEPT THE DIST OF EAST MIDNAPORE) & CLASSIFICATION OF CASES:[1> ALL NON-RESIDENTS INCLUDING FOREIGN COMPANIES WITH NAMES STARTING FROM M TO S | DLC | C | 512 | 2 | |

| ACIT INTERNATIONAL BHUBANESWAR | — | DLC | C | 512 | 3 | |

| DCIT INTERNATIONAL TAXATION 1(1) CHENNAI | CCIT I,II,III,IV,V CHENNAI | DLC | C | 513 | 1 | |

| DCIT INTERNATIONAL TAXATION 1(2) CHENNAI | — | DLC | C | 513 | 2 | |

| CIRCLE INTERNATIONAL TAXATION KOCHI | I)ALL FUNCTIONS AND POWERS INCLUDING TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 IN RESPECT OF PERSONS MENTIONED AT (A) & (B) BELOW. (A)PERSONS BEING NON-RESIDENTS INCLUDING FOREIGN COMPANIES WITHIN THE MEANING OF SUB SECTION(23A) OF SECTION 2 OF THE INCOME TAX ACT, 1961 AND HAVING A PERMANENT ESTABLISHMENT IN TERMS OF APPLICABLE DOUBLE TAX AVOIDANCE AGREEMENT IN THE AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CCIT, KOCHI INCLUDING THE UNION TERRITORY OF LAKSHADWEEP OR HAVING A BUSINESS CONNECTION OR HAVING ANY SOURCE OF INCOME WHICH (I) IS RECEIVED OR DEEMED TO BE RECEIVED IN INDIA; (II) ACCRUES OR ARISES OR DEEMED TO ACCRUE OR ARISE IN INDIA IN THE AREAS AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CCIT, KOCHI INCLUDING THE UNION TERRITORY OF LAKSHADWEEP AND WHOSE TOTAL INCOME/LOSS IS RS. 20 LAKHS AND ABOVE AS PER THE LATEST RETURN FILED/RETURN PENDING FOR SCRUTINY ASSESSMENT/LAST ASSESSED INCOME IN CASE OF COMPANIES AND WHOSE TOTAL INCOME/LOSS IS RS. 15 LAKHS AND ABOVE AS PER THE LATEST RETURN FILED/RETURN PENDING FOR SCRUTINY ASSESSMENT IN THE CASE OF ASSESSES OTHER THAN COMPANIES. (A) ANY OTHER CASE ASSIGNED BY THE COMMISSIONER OF INCOME TAX (INTL. TAX), BANGALORE, OR ADDITIONAL/JOINT COMMISSIONER OF INCOME TAX (INTL. TAX), KOCHI. (II) ALL CASES OF TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 ON PAYMENT MADE TO NON-RESIDENTS AND FOREIGN COMPANIES IN RESPECT OF PERSONS BEING COMPANIES REGISTERED UNDER THE COMPANIES ACT 2013 OR THE COMPANIES ACT 1956 AND HAVING REGISTERED OFFICE OR PRINCIPAL PLACE OF BUSINESS IN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CCIT, KOCHI INCLUDING THE UNION TERRITORY OF LAKSHADWEEP | DLC | C | 514 | 1 | |

| DCIT CIRCLE INTERNATIONAL TAXATION, TRIVANDRUM | (I)ALL FUNCTIONS AND POWERS INCLUDING TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 IN RESPECT OF PERSONS MENTIONED AT I(A) & I(B) BELOW. (A) PERSONS BEING NON-RESIDENTS INCLUDING FOREIGN COMPANIES WITHIN THE MEANING OF SUB SECTION(23A) OF SECTION 2 OF THE INCOME TAX ACT, 1961 AND HAVING A PERMANENT ESTABLISHMENT IN TERMS OF APPLICABLE DOUBLE TAX AVOIDANCE AGREEMENT IN THE AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF CCIT, THIRUVANANTHAPURAM OR HAVING A BUSINESS CONNECTION OR HAVING ANY SOURCE OF INCOME WHICH (I) IS RECEIVED OR DEEMED TO BE RECEIVED IN INDIA; (II) ACCRUES OR ARISES OR DEEMED TO ACCRUE OR ARISE IN INDIA IN THE AREAS AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF CCIT, THIRUVANANTHAPURAM. (B) ANY OTHER CASE ASSIGNED BY THE COMMISSIONER OF INCOME TAX (INTL. TAX), BANGALORE, OR ADDITIONAL/JOINT COMMISSIONER OF INCOME TAX (INTL. TAX), KOCHI. (II) ALL CASES OF TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 ON PAYMENT MADE TO NON-RESIDENTS AND FOREIGN COMPANIES IN RESPECT OF PERSONS BEING OTHER THAN COMPANIES DERIVING INCOME FROM BUSINESS/ PROFESSION OR SOURCES OTHER THAN INCOME FROM BUSINESS OR PROFESSION AND RESIDING/WHOSE PRINCIPAL PLACE OF BUSINESS IS WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF CCIT, THIRUVANANTHAPURAM. (III) ANY OTHER PERSON OTHER THAN COMPANIES RESPONSIBLE FOR DEDUCTING AT SOURCE UNDER CHAPTER XVII/XVII B OF INCOME TAX ACT 1961 WITHIN THE TERRITORIAL AREA OF CCIT, THIRUVANANTHAPURAM | DLC | C | 515 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 2(1) CHENNAI | — | DLC | C | 518 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 2(2) CHENNAI | — | DLC | C | 518 | 2 | |

| INTERNATIONAL TAXATIONN CIRCLE COIMBATORE | — | DLC | C | 519 | 1 | |

| INTERNATIONAL TAXATIONN CIRCLE MADURAI | — | DLC | C | 519 | 2 | |

| DCIT ASMNT CIR 2(1), BANGALORE | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF BANGALORE URBAN AND RURAL AND AREA LYING WITHIN THE TERRITORIAL LIMIT OF BAGALKOT, BELGAUM, BIDAR, BIJAPUR, GULBARGA, RAICHUR AND YADGIR THE DISTRICTS OF IN THE STATE OF KARNATAKA AND HAVING/CONTAINING THE FIFTH LETTER/CHARACTER IN THE PAN FROM S TO Z OR LAST NAME/SURNAME STARTING WITH LETTER/CHARACTER S TO Z IN CASES WHERE PAN HAS NOT BEEN OBTAINED, HAVING LATEST RETURNED INCOME/LOSS MORE THAN RS.20 LAKHS (RS.30 LAKHS IN CASE OF FOREIGN COMPANIES) | DLC | C | 520 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 2(2) BANGALORE | ALL THE CASES OF PERSONS WITHIN THE AREA LYING WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF IN THE STATE OF KARNATAKABANGALORE URBAN AND RURAL AREA LYING WITHIN THE TERRITORIAL LIMIT OF BELLARY, CHIKMAGALUR, CHITRADURGA, DAKSHIN KANNADA, DAVANGERE, DHARWAD, GADAG, HAVERI, KOPPAL, SHIMOGA, KODAGU, UDUPI AND UTTARA KANNADA IN TERRITORIAL LIMIT OF THE STATE OF KARNATAKA | DLC | C | 520 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 1(1)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘AA’ TO ‘AM’ | DLC | C | 521 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 1(1)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘AN’ TO ‘AZ’ | DLC | C | 521 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 4(1)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘R’ | DLC | C | 522 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 4(1)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘T’ | DLC | C | 522 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 2(2)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘H’,’IO’ TO ‘IZ’ | DLC | C | 523 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 2(2)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘E’,’IA’ TO ‘IN’ | DLC | C | 523 | 2 | |

| INTERNATIONAL TAXATION CIRCLE 3(2)(1), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘MA’ TO ‘MH’ | DLC | C | 524 | 1 | |

| INTERNATIONAL TAXATION CIRCLE 3(2)(2), MUMBAI | NON RESIDENT NON INDIVIDUAL (COMPANIES/AOPS/TRUSTS ETC) CASES OF MUMBAI,THANE,RAIGAD STARTING WITH ALPHABETS ‘MI’ TO ‘MZ’,’O’ | DLC | C | 524 | 2 | |

| ADIT(INTERNATIONAL TAXATIONN)-1, HYDERABAD | — | APR | C | 525 | 1 | |

| ADIT(INTERNATIONAL TAXATIONN)-2, HYDERABAD | — | APR | C | 525 | 2 | |

| ADIT(INTERNATIONAL TAXATIONN)-3 VISHAKHAPATNAM | — | APR | C | 525 | 3 | |

| CIRCLE,INTERNATIONAL TAXATION, VISHAKHAPATNAM | — | APR | C | 526 | 1 | |

| DC/ACIT TP-1, AHMEDABAD | — | DLC | C | 554 | 1 | |

| DC/ACIT TP-2, AHMEDABAD | — | DLC | C | 554 | 2 | |

| CIRCLE (INTERNATIONAL TAXATION) 1, AHMEDABAD | — | DLC | C | 555 | 1 | |

| CIRCLE (INTERNATIONAL TAXATION) 2, AHMEDABAD | — | DLC | C | 555 | 2 | |

| CIRCLE INTERNATIONAL TAXATION, VADODARA | — | DLC | C | 556 | 1 | |

| ADIT(INTERNATIONAL TAXATION) GANDHIDHAM | — | DLC | C | 557 | 1 | |

| ACIT INTERNATIONAL TAXATION BHUBANESWAR | — | DLC | C | 559 | 1 | |

| DDIT/ADIT( INTERNATIONAL TAXATION) NOIDA | — | DLC | C | 560 | 1 | |

| DDIT/ADIT(INTERNATIONAL TAXATION) LUCKNOW | — | DLC | C | 560 | 2 | |

| DDIT/ ADIT( INTERNATIONAL) 1 DEHRADUN | A TO M INCOMETAX OFFICE, DEHRADUN | DLC | C | 561 | 1 | |

| DDIT/ ADIT( INTERNATIONAL) 2 DEHRADUN | N TO Z INCOMETAX OFFICE, DEHRADUN | DLC | C | 561 | 2 | |

| DDIT/ADIT INTERNATIONAL TAXATION LUCKNOW | — | DLC | C | 791 | 1 | |

| ADIT(INTERNATIONAL TAXATION), JAIPUR AT JODHPUR | — | DLC | C | 840 | 1 | |

| WARD INTERNATIONAL TAXATION 1(1)(2) DELH | — | DLC | W | 35 | 3 | |

| ITO INTERNATIONAL TAXATION, NASHIK | — | DLC | W | 85 | 1 | |

| WARD INTERNATIONAL TAXATION. 2(1)(1) | — | DLC | W | 122 | 31 | |

| WARD INTERNATIONAL TAXATION 2(1)(2) | — | DLC | W | 122 | 32 | |

| ITO(INTERNATIONAL TAXATION)-1,CHANDIGARH | — | DLC | W | 124 | 1 | |

| ITO (INTERNATIONAL TAXATION), KANPUR | — | DLC | W | 128 | 1 | |

| ITO (INTERNATIONAL TAXATION), NAGPUR | — | DLC | W | 130 | 1 | |

| ITO(INTERNATIONAL- TAXATION) GURGAON | — | DLC | W | 200 | 1 | |

| WARD INTERNATIONAL TAXATION 1(2)(1) | — | DLC | W | 254 | 1 | |

| WARD INTERNATIONAL TAXATION 1(2)(2) | — | DLC | W | 254 | 2 | |

| WARD INTERNATIONAL TAXATION 1(3)(1) | — | DLC | W | 255 | 1 | |

| WARD INTERNATIONAL TAXATION 1(3)(2) | — | DLC | W | 255 | 2 | |

| INTERNATIONAL TAXATION WARD 1(2)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘BA’ TO ‘BL’ | DLC | W | 280 | 1 | |

| INTERNATIONAL TAXATION WARD 1(2)(2), MUMBAI | — | DLC | W | 280 | 2 | |

| INTERNATIONAL TAXATION WARD 1(3)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘BM’ TO ‘BZ’ | DLC | W | 281 | 1 | |

| INTERNATIONAL TAXATION WARD 1(3)(2), MUMBAI | — | DLC | W | 281 | 2 | |

| INTERNATIONAL TAXATION WARD 2(1)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘C’,’D’ | DLC | W | 283 | 1 | |

| INTERNATIONAL TAXATION WARD 2(1)(2), MUMBAI | — | DLC | W | 283 | 2 | |

| INTERNATIONAL TAXATION WARD 2(3)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘F’,’G’ | DLC | W | 284 | 1 | |

| INTERNATIONAL TAXATION WARD 2(3)(2), MUMBAI | — | DLC | W | 284 | 2 | |

| INTERNATIONAL TAXATION WARD 3(1)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘J’,’K’,’L’ | DLC | W | 286 | 1 | |

| INTERNATIONAL TAXATION WARD 3(1)(2), MUMBAI | — | DLC | W | 286 | 2 | |

| INTERNATIONAL TAXATION WARD 3(3)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘N’,’P’,’Q’ | DLC | W | 287 | 1 | |

| INTERNATIONAL TAXATION WARD 3(3)(2), MUMBAI | — | DLC | W | 287 | 2 | |

| INTERNATIONAL TAXATION WARD 4(2)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘S’ | DLC | W | 289 | 1 | |

| INTERNATIONAL TAXATION WARD 4(2)(2), MUMBAI | — | DLC | W | 289 | 2 | |

| INTERNATIONAL TAXATION WARD 4(3)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘U’ TO ‘Z’ | DLC | W | 290 | 1 | |

| INTERNATIONAL TAXATION WARD 4(3)(2), MUMBAI | — | DLC | W | 290 | 2 | |

| ITO(IT&TP), BHOPAL | — | DLC | W | 292 | 1 | |

| INTERNATIONAL TAXATION WARD PATNA | — | DLC | W | 305 | 1 | |

| IT & TP WARD RANCHI | — | DLC | W | 306 | 1 | |

| ITO(IT&TP), BHOPAL at JABALPUR | — | DLC | W | 310 | 1 | |

| (IT) WARD 1, PUNE | — | DLC | W | 400 | 1 | |

| (IT) WARD 2, PUNE | — | DLC | W | 400 | 2 | |

| (IT) WARD 3, PUNE | — | DLC | W | 400 | 3 | |

| (IT) WARD 4, PUNE | — | DLC | W | 400 | 4 | |

| WARD INTERNATIONAL TAXATION 1(1), BANGALORE | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF BANGALORE URBAN AND RURAL AND AREA LYING WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF CHIKKABALLAPUR, CHAMARAJANAGAR, HASSAN, KOLAR, MANDYA, RAMNAGARA, MYSORE AND TUMKUR IN THE STATE OF KARNATAKA AND HAVING/CONTAINING THE FIFTH LETTER/CHARACTER IN THE PAN FROM A TO J OR LAST NAME/SURNAME STARTING WITH LETTER/CHARACTER A TO J IN CASES WHERE PAN HAS NOT BEEN OBTAINED, HAVING LATEST RETURNED INCOME/LOSS MORE THAN RS.20 LAKHS (RS.30 LAKHS IN CASE OF FOREIGN COMPANIES). | DLC | W | 510 | 1 | |

| WARD INTERNATIONAL TAXATION 1(2), BANGALORE | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF BANGALORE URBAN AND RURAL IN THE STATE OF KARNATAKA AND HAVING/CONTAINING THE FIFTH LETTER/CHARACTER IN THE PAN FROM K TO R OR LAST NAME/SURNAME STARTING WITH LETTER/CHARACTER K TO R IN CASES WHERE PAN HAS NOT BEEN OBTAINED, HAVING LATEST RETURNED INCOME/LOSS MORE THAN RS.20 LAKHS (RS.30 LAKHS IN CASE OF FOREIGN COMPANIES). | DLC | W | 510 | 2 | |

| ITO(IT) WARD, KOLKATA | TERRITORIAL AREA:WEST BENGAL(EXCEPT THE DIST OF EAST MIDNAPORE) WITH CASES:>ALL TDS CASES U/S 195 & 197 WITH NAMES STARTING FROM A-L;TERRITORIAL AREA:>ANDAMAN & NICOBOR ISLANDS & SIKKIM WITH ALL TDS CASES U/S 195 & 197 | DLC | W | 511 | 1 | |

| ITO(IT) WARD-HALDIA | TERRITORIAL AREA, (EAST MIDNAPORE) | DLC | W | 511 | 2 | |

| ITO INTERNATIONAL TAXATION PARADEEP | — | DLC | W | 512 | 3 | |

| INTERNATIONAL TAXATION WARD 1(1) CHENNAI | CCIT I,II,III,IV,V CHENNAI | DLC | W | 513 | 1 | |

| INT. TAXN WARD 1(2) CHENNAI | CCIT I,II,III,IV,V CHENNAI | DLC | W | 513 | 2 | |

| WARD INTERNATIONAL TAXATION, KOCHI | (I)ALL FUNCTIONS AND POWERS INCLUDING TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 IN RESPECT OF PERSONS MENTIONED AT I(A) & I(B) BELOW. (A) PERSONS BEING NON-RESIDENTS INCLUDING FOREIGN COMPANIES WITHIN THE MEANING OF SUB SECTION(23A) OF SECTION 2 OF THE INCOME TAX ACT, 1961 AND HAVING A PERMANENT ESTABLISHMENT IN TERMS OF APPLICABLE DOUBLE TAX AVOIDANCE AGREEMENT IN THE AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CIT/CIT, KOCHI-1, PR.CIT/CIT, KOCHI-2 AND PR.CIT/CIT, THRISSUR OR HAVING A BUSINESS CONNECTION OR HAVING ANY SOURCE OF INCOME WHICH (I) IS RECEIVED OR DEEMED TO BE RECEIVED IN INDIA; (II) ACCRUES OR ARISES OR DEEMED TO ACCRUE OR ARISE IN INDIA IN THE AREAS AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CIT/CIT, KOCHI-1, PR.CIT/CIT, KOCHI-2 AND PR.CIT/CIT, THRISSUR AND WHOSE TOTAL INCOME/LOSS IS BELOW RS. 20 LAKHS AS PER THE LATEST RETURN FILED/RETURN PENDING FOR SCRUTINY ASSESSMENT/LAST ASSESSED INCOME IN CASE OF COMPANIES AND WHOSE TOTAL INCOME/LOSS IS BELOW RS. 15 LAKHS AS PER THE LATEST RETURN FILED/RETURN PENDING FOR SCRUTINY ASSESSMENT IN THE CASE OF ASSESSES OTHER THAN COMPANIES. (B) ANY OTHER CASE ASSIGNED BY THE COMMISSIONER OF INCOME TAX (INTL. TAX), BANGALORE, OR ADDITIONAL/JOINT COMMISSIONER OF INCOME TAX (INTL. TAX), KOCHI. (II) ALL CASES OF TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 ON PAYMENT MADE TO NON-RESIDENTS AND FOREIGN COMPANIES IN RESPECT OF PERSONS BEING OTHER THAN COMPANIES DERIVING INCOME FROM BUSINESS/ PROFESSION OR SOURCES OTHER THAN INCOME FROM BUSINESS OR PROFESSION AND RESIDING/WHOSE PRINCIPAL PLACE OF BUSINESS IS WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION PR.CIT/CIT, KOCHI-1, PR.CIT/CIT, KOCHI-2 AND PR.CIT/CIT, THRISSUR. (III) ANY OTHER PERSON OTHER THAN COMPANIES RESPONSIBLE FOR DEDUCTING AT SOURCE UNDER CHAPTER XVII/XVII B OF INCOME TAX ACT 1961 WITHIN THE TERRITORIAL AREA OF PR.CIT/CIT, KOCHI-1, PR.CIT/CIT, KOCHI-2 AND PR.CIT/CIT, THRISSUR. | DLC | W | 514 | 1 | |

| WARD INTERNATIONAL TAXATION, KOZHIKODE | (I)ALL FUNCTIONS AND POWERS INCLUDING TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 IN RESPECT OF PERSONS MENTIONED AT I(A) & I(B) BELOW. (A) PERSONS BEING NON-RESIDENTS INCLUDING FOREIGN COMPANIES WITHIN THE MEANING OF SUB SECTION(23A) OF SECTION 2 OF THE INCOME TAX ACT, 1961 AND HAVING A PERMANENT ESTABLISHMENT IN TERMS OF APPLICABLE DOUBLE TAX AVOIDANCE AGREEMENT IN THE AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CIT/CIT KOZHIKODE INCLUDING THE DISTRICT OF MAHE WITHIN THE UNION TERRITORY OF PUDUCHERRY OR HAVING A BUSINESS CONNECTION OR HAVING ANY SOURCE OF INCOME WHICH (I) IS RECEIVED OR DEEMED TO BE RECEIVED IN INDIA; (II) ACCRUES OR ARISES OR DEEMED TO ACCRUE OR ARISE IN INDIA IN THE AREAS AREAS LYING WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CIT/CIT KOZHIKODE INCLUDING THE DISTRICT OF MAHE WITHIN THE UNION TERRITORY OF PUDUCHERRY AND WHOSE TOTAL INCOME/LOSS IS BELOW RS. 20 LAKHS AS PER THE LATEST RETURN FILED/RETURN PENDING FOR SCRUTINY ASSESSMENT/LAST ASSESSED INCOME IN CASE OF COMPANIES AND WHOSE TOTAL INCOME/LOSS IS BELOW RS. 15 LAKHS AS PER THE LATEST RETURN FILED/RETURN PENDING FOR SCRUTINY ASSESSMENT IN THE CASE OF ASSESSES OTHER THAN COMPANIES. (B) ANY OTHER CASE ASSIGNED BY THE COMMISSIONER OF INCOME TAX (INTL. TAX), BANGALORE, OR ADDITIONAL/JOINT COMMISSIONER OF INCOME TAX (INTL. TAX), KOCHI. (II) ALL CASES OF TAX DEDUCTION AT SOURCE UNDER SECTIONS 194E, 194LB, 194LBA(2), 194LC, 194LD, 195, 196A, 196B, 196C, 196D AND 197 OF THE INCOME TAX ACT 1961 ON PAYMENT MADE TO NON-RESIDENTS AND FOREIGN COMPANIES IN RESPECT OF PERSONS BEING OTHER THAN COMPANIES DERIVING INCOME FROM BUSINESS/ PROFESSION OR SOURCES OTHER THAN INCOME FROM BUSINESS OR PROFESSION AND RESIDING/WHOSE PRINCIPAL PLACE OF BUSINESS IS WITHIN THE TERRITORIAL LIMITS UNDER THE JURISDICTION OF PR.CIT/CIT KOZHIKODE INCLUDING THE DISTRICT OF MAHE WITHIN THE UNION TERRITORY OF PUDUCHERRY. (III) ANY OTHER PERSON OTHER THAN COMPANIES RESPONSIBLE FOR DEDUCTING AT SOURCE UNDER CHAPTER XVII/XVII B OF INCOME TAX ACT 1961 WITHIN THE TERRITORIAL AREA OF PR.CIT/CIT KOZHIKODE INCLUDING THE DISTRICT OF MAHE WITHIN THE UNION TERRITORY OF PUDUCHERRY. | DLC | W | 514 | 3 | |

| INTERNATIONAL TAXATION WARD 2(1) CHENNAI | CCIT I,II,III,IV,V CHENNAI | DLC | W | 518 | 1 | |

| INTERNATIONAL TAXATION WARD 2(2) CHENNAI | CCIT I,II,III,IV,V CHENNAI | DLC | W | 518 | 2 | |

| INTERNATIONAL TAXATIONN WARD COIMBATORE | — | DLC | W | 519 | 1 | |

| INTERNATIONAL TAXATIONN WARD TUTICORIN | — | DLC | W | 519 | 2 | |

| INTERNATIONAL TAXATION WARD 2(1), BANGALORE | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL LIMIT OF THE DISTRICTS OF BANGALORE URBAN AND RURAL AND HAVING/CONTAINING THE FIFTH LETTER/CHARACTER IN THE PAN FROM S TO Z OR LAST NAME/SURNAME STARTING WITH LETTER/CHARACTER S TO Z IN CASES WHERE PAN HAS NOT BEEN OBTAINED, HAVING LATEST RETURNED INCOME/LOSS MORE THAN RS.20 LAKHS (RS.30 LAKHS IN CASE OF FOREIGN COMPANIES) | DLC | W | 520 | 1 | |

| INTERNATIONAL TAXATION WARD, PANJI | ALL THE CASES OF PERSONS WITHIN THE TERRITORIAL AREA LYING WITHIN THE TERRITORIAL LIMIT OF BAGALKOT, BELGAUM, BIDAR, BIJAPUR, GULBARGA, RAICHUR AND YADGIR THE DISTRICTS OF IN THE STATE OF KARNATAKA AND AREA LYING WITHIN THE TERRITORIAL LIMIT IN THE STATE OF GOA AND HAVING LATEST RETURNED INCOME/LOSS EXCEEDING RS.15 LAKHS (RS.20 LAKHS IN CASE OF FOREIGN COMPANIES) | DLC | W | 520 | 2 | |

| ITO INTERNATIONAL TAXATION WARD MANGALORE | — | DLC | W | 520 | 3 | |

| INTERNATIONAL TAXATION WARD 1(1)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘A’ | DLC | W | 521 | 1 | |

| INTERNATIONAL TAXATION WARD 1(1)(2), MUMBAI | — | DLC | W | 521 | 2 | |

| INTERNATIONAL TAXATION WARD 4(1)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘R’,’T’ | DLC | W | 522 | 1 | |

| INTERNATIONAL TAXATION WARD 4(1)(2), MUMBAI | — | DLC | W | 522 | 2 | |

| INTERNATIONAL TAXATION WARD 2(2)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘E’,’H’,’I’ | DLC | W | 523 | 1 | |

| INTERNATIONAL TAXATION WARD 2(2)(2), MUMBAI | — | DLC | W | 523 | 2 | |

| INTERNATIONAL TAXATION WARD 3(2)(1), MUMBAI | NON RESIDENT INDIVIDUALS CASES OF MUMBAI,THANE,RAIGAD LASTNAME/SURNAME STARTING WITH ALPHABETS ‘M’,’O’ | DLC | W | 524 | 1 | |

| INTERNATIONAL TAXATION WARD 3(2)(2), MUMBAI | — | DLC | W | 524 | 2 | |

| ITO(INTERNATIONAL TAXATIONN)-1, HYDERABAD | — | APR | W | 525 | 1 | |

| ITO(INTERNATIONAL TAXATIONN)-2, HYDERABAD | — | APR | W | 525 | 2 | |

| ITO(INTERNATIONAL TAXATIONN)-3 VISHAKHAPATNAM | — | APR | W | 525 | 3 | |

| WARD INTERNATIONAL TAXATION VISHAKHAPATNAM | — | APR | W | 526 | 1 | |

| WARD INTERNATIONAL TAXATION,KAKINADA | — | APR | W | 526 | 2 | |

| WARD INTERNATIONAL TAXATION, VIJAYAWADA | — | APR | W | 526 | 3 | |

| WARD INTERNATIONAL TAXATION, NELLORE | — | APR | W | 526 | 4 | |

| WARD 1, INTERNATIONAL TAXATION, AHMEDABAD | DIST : AHMEDABAD, GANDHINAGAR, BHAVNAGAR, BOTAD, SURENDRANAGAR, MEHSANA, PATAN, BANASKHATHA(PALANPUR), SABARKANTHA(HIMATNAGAR), ARAVALLI | DLC | W | 555 | 1 | |

| WARD 2, INTERNATIONAL TAXATION, AHMEDABAD | — | DLC | W | 555 | 2 | |

| OLD WD INTERNATIONAL TAXATION, VADODARA | — | DLC | W | 556 | 1 | |

| ITO.(INTERNATIONAL TAXATION)GANDHIDHAM | — | DLC | W | 557 | 1 | |

| AC / DC (INTERNATIONAL TAXATION) RAJKOT | — | DLC | W | 557 | 2 | |

| ITO (INTERNATIONAL TAXATION) SURAT | — | DLC | W | 558 | 1 | |

| INTERNATIONAL TAXATION WARD, PARADEEP | PARADEEP PORT | DLC | W | 559 | 1 | |

| ITO INTERNATIONAL TAXATION PARADEEP | — | DLC | W | 559 | 3 | |

| ITO (INTERNATIONAL TAXATION) NOIDA | — | DLC | W | 560 | 2 | |

| ITO (INTERNATIONAL TAXATION) KANPUR | — | DLC | W | 560 | 3 | |

| ITO(INTERNATIONAL TAXATION) DEHRADUN | — | DLC | W | 561 | 1 | |

| ITO IT&TP KOLKATA AT GUWAHATI | — | DLC | W | 603 | 1 |

It is Mandatory for the applicants to mention the AO code in the PAN application. The AO code under jurisdiction of which the applicant falls, should be selected by the applicant. The applicants are advised to be careful in selection of the AO code, AO Number: This denotes the assessing officer number assigned to that particular ward/circle. Such AO code is required to be quoted in PAN application. You can get the information from the income tax department. Alternatively, you can find this information online, International Ao Code for PAN Card Apply, NRI Pan Ao Code, out of india pan ao code, nri citizenship pan card ao code, USA – Canada Citizen PAN Ao Code for Pan Card Apply, Canada Japan Germany Switzerland. Australia United States New Zealand United Kingdom PAN Card Ao Code.

Indian Pan Ao Code for NRI is DLC-C-35-1, USA citizen pan card ao code is DLC-C-35-1. Canada citizen pan card ao code is DLC-C-35-1.

Disclaimer: Users are advised to verify information with the respective income tex deperment before using the information provided. NSDL